My dad is and was a financial whiz. So having a magazine devoted to finance and investing to him was a no brainer. That was actually my first introduction to Thomas Sowell. Every edition of Forbes had an essay by Thomas Sowell on the very last page. I spent a lot of time in my single digits asking my parents to tell me what a word meant because I had read it in Sowell's essay and I couldn't understand it. They eventually introduced me to a dictionary so that I would stop bothering them.

After I moved out and joined the Army, my dad paid for subscriptions to both Forbes and National Review for my brother and I. Every duty station, every new place, I had a Forbes magazine and a National Review showing up in my mail box.

I can remember when he said he was stopping the subscription of National Review. It was right after the "After Trump" edition came out, when NR exposed themselves as the Democrat fellating shitbag beltway swamp slugs they truly were. Dad and I talked about it, we were both disgusted, and so we said "adios" to National Review after that.

In that span of time, Forbes also underwent a change for the worse. They dropped Sowell, they picked up some newer writers, and the focus of their magazine changed. It was less about how stocks were trending, and which area of investing was hot or cold, and it became more about the "Look at this new thing! It's new!" A lot more politics started coming into play, creeping into their supposed investment advice like mold over a wall. The lists of the "Hot New Thing (under 30!)" or "Up and coming players in the investing world! (under 30!)". Lots of "influential" people on that list, meaning that they were politically connected to the Obama administration. They would have multi-page sections talking about investment opportunities in places like Dubai or some other country that were actually advertisements, but they didn't identify themselves as ads.

I think it was when one of those popped up, talking about how great it is to move your manufacturing to China, that dad and I once again had a talk, and he mentioned that he wasn't getting any real good information out of Forbes anymore, and so it was time to cut the subscription.

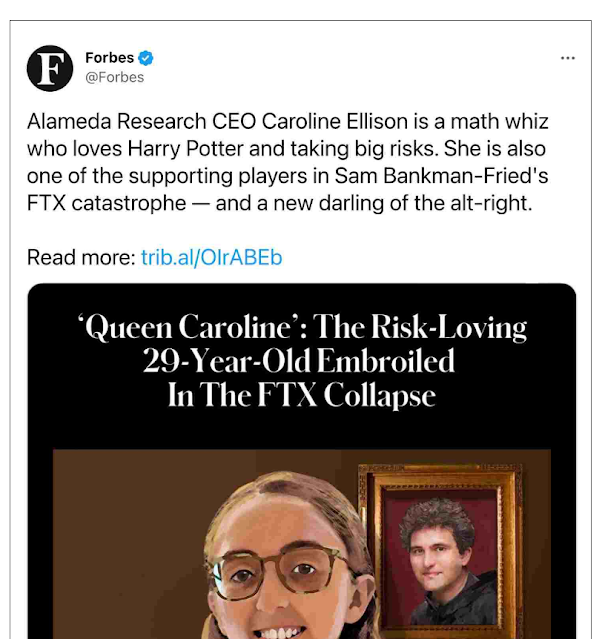

Anyways.... All of that popped in to my head when I saw this:

The link goes to Instapundit, who has a whole compendium of how badly Forbes has screwed the pooch with their supposed reporting.

What is hilarious about this–actually there are many things hilarious about this–is that FTX is actually a darling of Forbes Magazine, who helped it vault to the top of the crypto world. Forbes hyped the company, hyped Sam Bankman-Fried as a genius, and along with the New York Times turned SBF into a hero, genius inventor. To the extent that Caroline the fraud was enabled, Forbes, Fortune Magazine, and the New York Times were the chief enablers.

The Times even listed Fried right alongside Janet Yellen, Zelensky, and Mark Zuckerberg as a speaker at a conference to be held…next week. After the collapse of the company–and their coverage of the firm’s collapse has been pathetic and sycophantic to SBF. The Times is covering its own ass, and Forbes has decided to do the same.

Right now I wouldn't take ANY investment advice from Forbes. I'd rather trust Wall Street Bets on reddit. I'd rather take the ramblings of a crackhead in Seattle as investment advice instead of listening to Forbes. THEY PUSHED FTX AND ITS FOUNDER AS A SOUND INVESTMENT! And if anyone, and I do mean anyone had bothered to due any kind of diligence in checking out a massive, multi-billion dollar crypto currency company, they would have found that the entire thing was a scam.

FTX FILLED ITS BANKRUPTCY FILLING TODAY

IT IS EVEN WORSE THAN ANYONE IMAGINED

AN OVERVIEW:

1) FTX LENT SAM BANKMAN OVER $1 BILLION DOLLARS FOR PERSONAL USE

2) FTX USED CUSTOMER FUNDS TO BUY HOUSES FOR EMPLOYEES

3) FTX DIDNT HAVE A LIST OF EMPLOYESS AND WHAT ALL THEY DID

4) FTX DID NOT KEEP ANY BOOKS OR RECORDS OF ITS DIGITAL ASSETS

5) ALAMEDA RESEARCH WAS EXEMPTED FROM AUTO LIQUIDATION ON FTX

6) FTX BUILT A SOFTWARE TO HIDE THE MISUSE OF CUSTOMER FUNDS

7) FTX HAD $400 MILLION IN UNAUTHORIZED TRANSFERS THE DAY THEY FILED FOR BANKRUPTCY

8) FTX HAD BILLIONS IN INVESTMENTS OTHER THAN CRYPTO BUT THERE ARE NO BOOKS OR RECORDS OF ANY OF IT.

9) SAM BANKMAN MADE ALL BUSINESS DECISIONS ON APPS THAT AUTO DELETED EVERYTHING AFTER SOME TIME

HE ENCOURAGED ALL EMPLOYEES TO DO THE SAME

Sam Bankfraud-Fried was touted as some sort of financial genius. But every picture I've ever seen of him makes him look like a fat, sloppy retard. Looking at that list up there, detailing just about everything wrong with FTX and how it "operated", I would bet that I'm far more correct than the people who touted him as a genius.

But that didn't matter to Forbes, did it? Especially with all those millions and billions of dollars being laundered through Ukraine and FTX back to the Democrat party. Oh, you didn't hear about that? The US Government under Democrat control (with stupid dipshit fuckstain party support) was giving it's billions to Ukraine. Ukraine was "buying" FTX. Billions of dollars worth. And Sam Bankfraud-Fried was in turn giving at least 40 million dollars back to the Democrats. And also the six stupid dipshit fuckstains who voted to impeach Trump. Funny how that works, eh?

Anyways.... there's a trip down memory lane with me, tied in with current events. Don't trust Forbes magazine. They're converged, and they have been for quite some time. And never, ever ever EVER allow yourself to be tricked into investing into a company that all the "smart people" tell you to invest in. Because that's how FTX was allowed to happen. In a just world, the people who pushed this scam would be publicly flogged and then hung from the neck until dead. But we don't live in a just world, alas.

No comments:

Post a Comment

Comments are moderated. If you do not see your comment immediately, wait until I get home from work.

Note: Only a member of this blog may post a comment.